Withdrawal Strategy #

Each year of your retirement, you must decide how much you will withdraw from your portfolio. Most people wish to withdraw the most that they can to maximize their quality of life, but not so much that they run out of money before the end of their retirement.

Changing the Withdrawal Strategy #

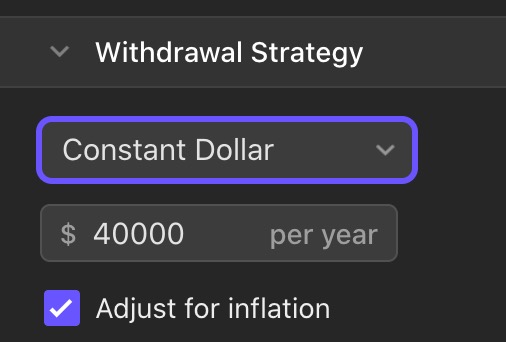

The default withdrawal strategy is called Constant Dollar. This is the strategy used in the studies that derived The 4% Rule.

To choose a different strategy, locate the dropdown menu in the "Withdrawal Strategy" section of the Configuration. All of the withdrawal strategy options are listed inside of it, organized by group.

Choosing the Right Withdrawal Strategy #

The right strategy for you depends on your goals and the things that you value in your retirement.

This is a deep topic; accordingly, there's an entire section of this guide dedicated to describing the different withdrawal strategy options. Read it here.

Determining the Amount to Withdraw #

Your withdrawal amount should cover all of your expenses for the year. Note that you should also include the cost of taxes to your withdrawal amount, as FI Calc does not automatically estimate what your taxes will be for each year.

For more, see the FAQ.