Extra Withdrawals #

Some years, you may need to make withdrawals beyond your "base" withdrawal amount. For example, you may be expecting to contribute to a child's college in a couple of years, or you may be planning to replace your car every 10 or 15 years.

FI Calc allows you to factor in extra withdrawals such as these into your simulations.

Adding Extra Withdrawals #

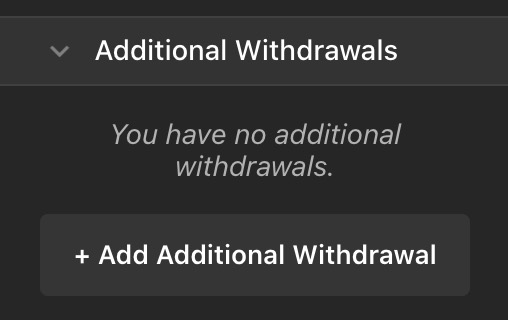

Begin by expanding the "Extra Withdrawals" section within the Configuration section of FI Calc.

Next, click the "Add Extra Withdrawals" button to open a window that lets you configure your withdrawals.

Name #

You may choose to label your withdrawal. Providing a name can help you to stay organized when you have multiple kinds of withdrawals. Example names are "New car," "Down payment," or "Kid's college."

Providing a name is optional.

Annual Amount #

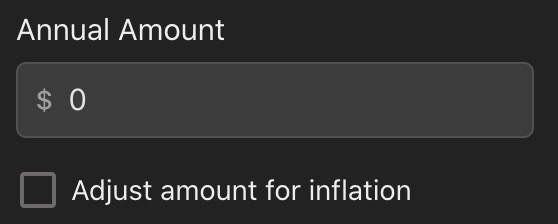

Extra withdrawals in FI Calc are made annually. For each type of withdrawal that you need to make, add up the total withdrawal for the year and enter it here.

Extra Withdrawals at monthly frequencies is not currently supported.

Adjusting for Inflation #

Over time, the dollar tends to afford you fewer and fewer things. This tendency is called "inflation." You may know that some of your withdrawal sources will be adjusted for inflation. For example, the price of college may be inflation-adjusted, while a mortgage payment likely isn't.

If your withdrawal should be adjusted for inflation then you should check this checkbox.

By default, inflation begins accumulating immediately, even when you specify that the withdrawals do not begin after a number of years.

You can change this so that inflation adjustments are only made after the withdrawals start. To do this, change the "Begin adjusting for inflation" dropdown from "immediately, at the first year" to "only after withdrawals start."

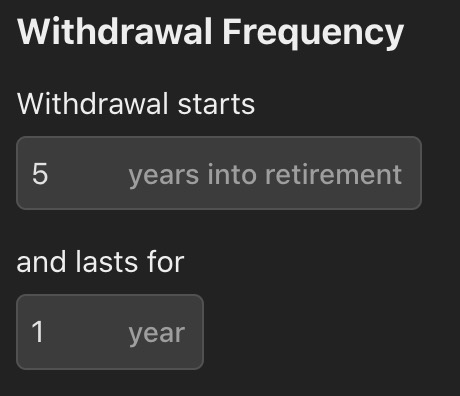

Withdrawal Frequency #

FI Calc supports complex withdrawal frequencies. For example, you may plan to pay for 4 years of college in 10 years.

Use the "Withdrawal Frequency" section to specify when you want your Extra Withdrawal to begin, and for how long.

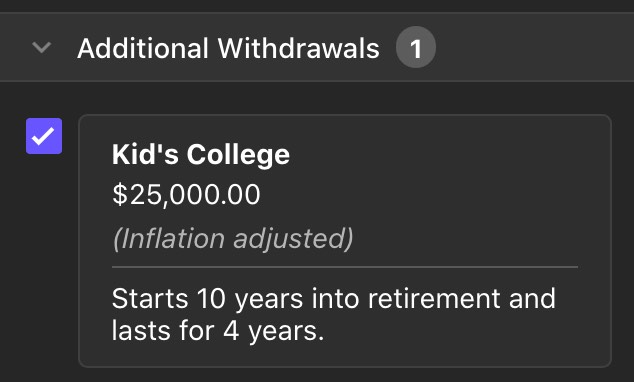

Modifying an Existing Extra Withdrawal #

You can make changes to an Extra Withdrawal that you have already created. To do so, click the target Extra Withdrawal in the list, and the edit window will appear. Make your changes, and then click Save.

Disabling One or More Extra Withdrawals #

You can temporarily disable an extra withdrawal to quickly see how it affects your rate of success. This can be more convenient than deleting it, because you can quickly enable it again at any time.

To disable an Extra Withdrawal, uncheck the checkbox next to the target withdrawal in the Configuration pane.

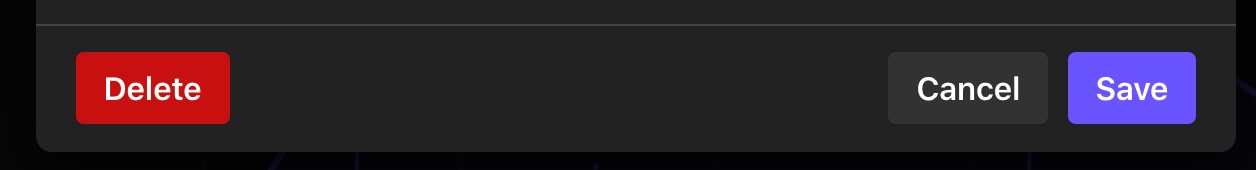

Deleting Extra Withdrawal #

To delete an Extra Withdrawal that you have created, click an existing Extra Withdrawal to open the Edit window. Then, click on the "Delete" button.

Effect on Your Withdrawal Strategy #

Sometimes, withdrawal strategies are dependent upon the previous year's withdrawal. In these situations, extra withdrawals do not factor in to their algorithms. This is to prevent a situation where your withdrawals can grow unbounded.

This is best demonstrated with an example.

With the 95% Rule, one of the Withdrawal Strategies you can choose in FI Calc, you are allowed to withdraw a percent of your portfolio or 95% of last year's withdrawal, whichever is larger.

Consider a year where you withdraw 4% of your $1,000,000 portfolio, equaling $40,000. And let's say you withdraw an additional $10,000 that year, making your total withdrawal equal to $50,000.

The following year, assume your portfolio is now $1,005,000 after gains, fees, and dividends are taken into account. 4% of that is $40,200. 95% of your previous withdrawal of $50,000 is $47,500. In this situation, 95% of the previous year withdrawal is larger than the 4% withdrawal, so you use it instead.

This trend will continue for as long as the $10,000 withdrawal occurs, and your total withdrawal will grow and grow. Often, this results in the portfolio running out of money, which is undesirable. Also, it against the intention of the 95% Rule, which is to smoothen out your withdrawals when the market is doing poorly.

FI Calc gets around this problem by not factoring in extra withdrawals in subsequent year calculations. In the above example, FI Calc would instead input the "base" withdrawal of $40,000 into the 95% Rule algorithm, which equals $38,000. This is less than the 4% withdrawal of your total portfolio, so when using FI Calc you would withdraw $40,200 the next year instead of $47,500.

The 95% Rule is not the only strategy that breaks when extra withdrawals are factored in, and for this reason FI Calc always ignores extra withdrawals when calculating subsequent year withdrawals.