Portfolio #

Your portfolio is the collection of assets that you own, including equities (stocks), bonds, and cash. When simulating your retirement plan using FI Calc, you specify the portfolio that you have, or plan to have, at the start of your retirement.

Presently, FI Calc supports entering three kinds of assets: equities, bonds, and cash.

Do you own real estate? Create Income to factor in earnings from your investment properties.

You're also able to specify whether you intend to rebalance your portfolio or not, and also if your allocation mix should change over time (a "glide path").

Deciding on a Portfolio Value #

If you're not sure how much to enter, begin by running simulations with the default value, $1,000,000. Experiment with the different withdrawal strategies to see how the withdrawal amounts compare to what you think you might need during retirement. From there, you can adjust the initial portfolio to find a value that feels right for you.

Entering Asset Types #

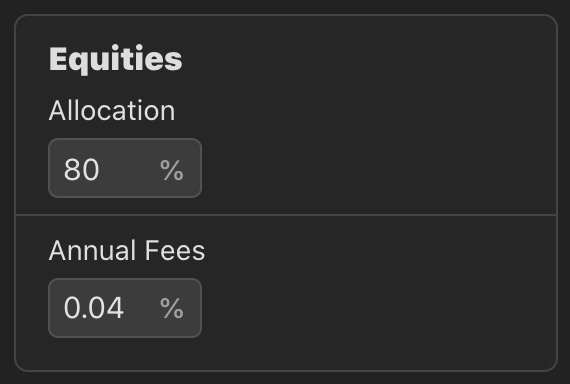

Equities #

There is a single input field for how much of your portfolio is stocks. If you have different kinds of stock investments, then you should add all of their values together to determine the percent of your portfolio that number is.

Additionally, you can also specify the annual fees, or expense ratio, for your stocks. Once again, we recommend inputting the average fees of your investments.

The default expense ratio, 0.04%, was the expense ratio of VTSAX in May 2020.

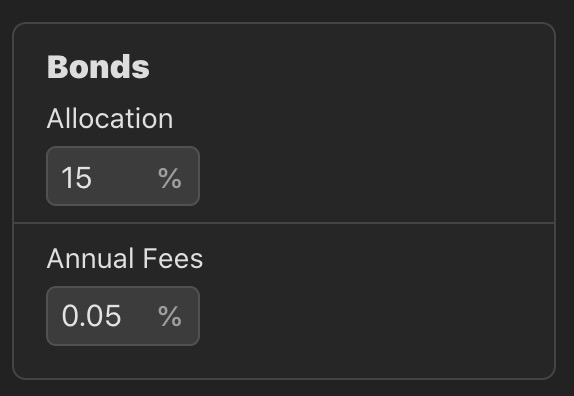

Bonds #

Just like stocks, there is a single input field for all of your bonds. Determine how much of your portfolio is made up of your bonds investments and enter that value here.

You may also specify the annual fees, or expense ratios, for your bonds.

The default expense ratio, 0.05%, was the expense ratio of VBTLX in May 2020.

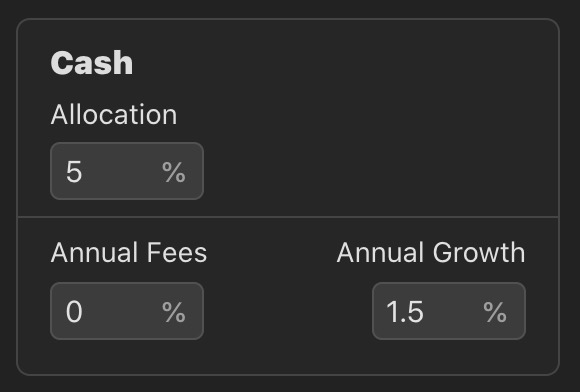

Cash #

Cash is entered in the same way that equities and bonds are.

One important thing to note is that unlike the other asset types, cash is not calculated using historical data. Instead, a fixed growth is used for cash, which defaults to 1.5%. This growth represents the interest earned in a high-interest savings account, for example.

Real Estate #

The equity that you have in real estate is not something that you can input into your FI Calc portfolio. What you can do is specify Income to account for rental property cash flow, or to account for money earned from selling a home.

Do you need more features for your real estate properties? If so, please let me know.

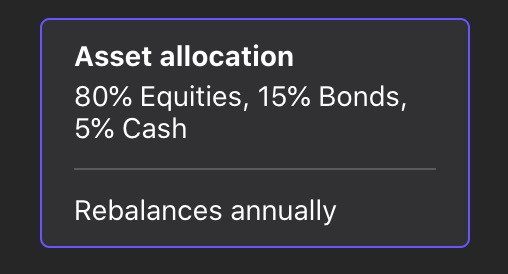

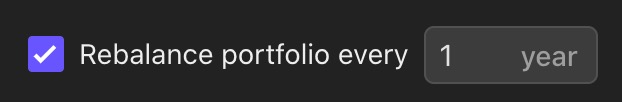

Rebalancing Your Portfolio #

By default, FI Calc ensures that your portfolio's asset allocation remains constant over time by rebalancing it each year.

Changing the Frequency of Rebalancing #

FI Calc rebalances annually by default, but you can rebalance at any frequency.

For example, to rebalance every other year, enter 2 as the frequency of rebalancing.

Disabling Rebalancing #

To disable rebalancing altogether uncheck the "Rebalance portfolio" checkbox. When you do this, the final portfolio mix will be determined entirely on the gains, fees, and dividends of your different asset types.

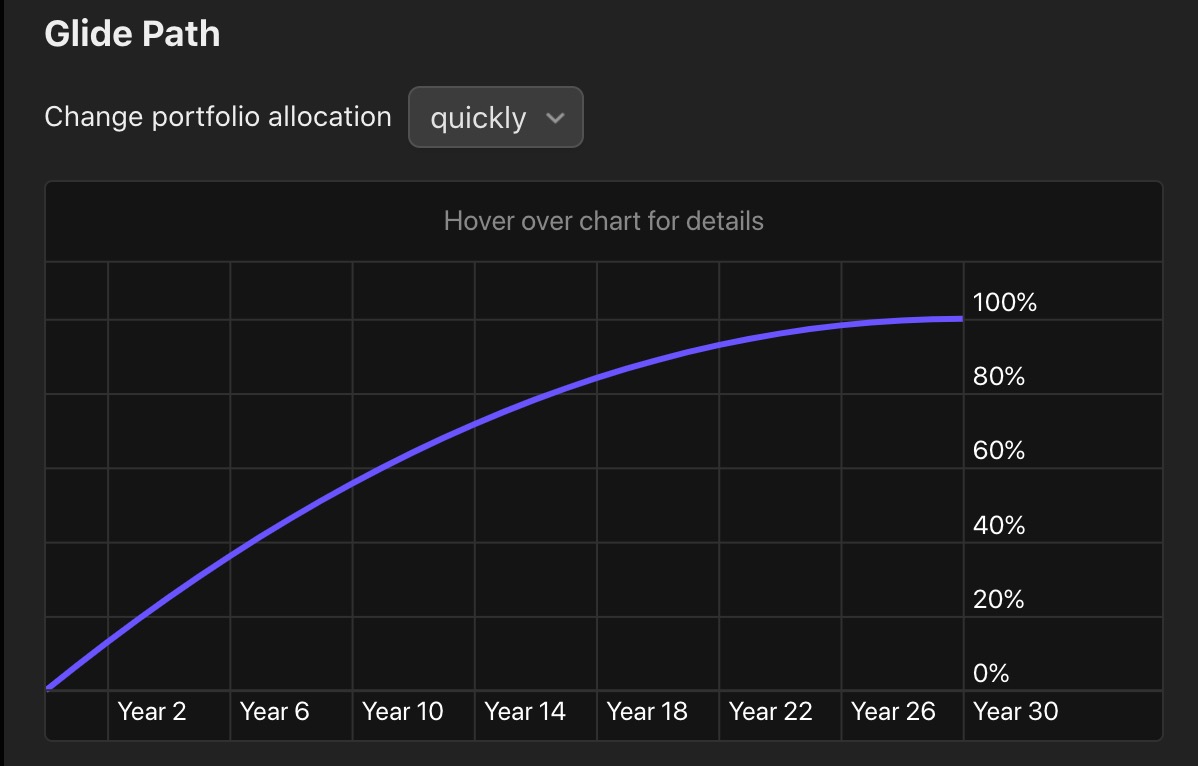

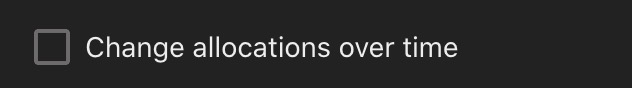

Changing Your Asset Allocation Over Time #

Sometimes, you may wish to have a different mix of assets at the end of your retirement than you had at the start. For example, you may wish to move more of your assets into bonds near the end of your retirement.

This is sometimes referred to as a "glide path."

To configure a glide path, first open the Portfolio Details window. Within that window, you will find a checkbox called "Change allocations over time." After checking it, new inputs will appear for the final portfolio allocations that you wish to have.

Keep in mind that the sum of your initial and final asset allocations must each add up to 100%.

Configuring the Glide Path #

You can further customize your glide path by choosing how quickly your assets settle on their final values. There are three options to choose from:

evenly: your allocations transition from their initial values to their final values evenly over time. Mathematically, this is a linear function.

slowly: your allocations remain close to their initial values at the start of your retirement. Mathematically, this is Penner's Quadratic In function.

quickly: your allocations more quickly settle on their final values. Mathematically, this is Penner's Quadratic Out function.